How Much Cash Do You Really Need to Buy a Home (Beyond the Down Payment)?

🏠 How Much Cash Do You Really Need to Buy a Home in Saskatoon?

🧮 Start With Your “Cash On Hand” Target

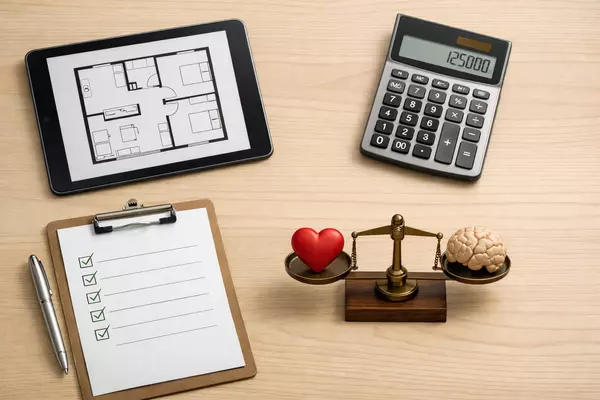

Most buyers start with one number in mind, the down payment. That is important, but it is not the full picture.

A better way to plan is to think in three buckets:

-

Down payment

-

Closing costs

-

Move in and early ownership costs

When you build your budget this way, you avoid getting approved for a home you cannot comfortably finish buying.

🏦 Down Payment Basics in Plain English

Your down payment is the portion of the purchase price you pay upfront. The rest is your mortgage.

Most people aim for 20% down because it can reduce extra costs and sometimes gives you more loan options. But you do not always need 20% to buy.

Here is the part many buyers miss. The down payment is only one piece of what you need to have saved. Even if you qualify for a mortgage, you still need cash ready for closing day and the first weeks after you get the keys.

📌 Pro Tip

If your down payment is coming from savings you are still building, decide early what your “cash leftover” number is. Buying a home and having $200 left in your account is not a win.

🧾 Closing Day Costs You Should Expect

Closing costs are the one-time expenses that show up between “offer accepted” and “keys in hand.” Some are paid before possession, and some are paid on possession day.

Common closing costs include:

Legal Fees And Disbursements

You need legal support to transfer ownership, register documents, and handle funds. There are also smaller add-on charges tied to registrations and searches.

Home Inspection

This is usually paid upfront. Even when a home looks great, an inspection can help you avoid surprise repairs right after you move in.

Appraisal

Some lenders require an appraisal to confirm the home’s value. This is not always needed, but it is smart to budget for it.

Title Insurance

This is often used to protect against certain title issues and paperwork problems. It is a common line item buyers see in their closing breakdown.

Land Title And Transfer Related Fees

There are fees connected to registering the transfer and mortgage. The exact totals depend on the purchase and how it is registered, but they should be part of your plan.

A simple rule that often works is to set aside a closing cost range as a percentage of the purchase price. It keeps you safe even when you do not know every exact number yet.

🛡️ Mortgage Insurance When You Put Less Than 20% Down

If you buy with less than 20% down, you will usually need mortgage default insurance. This is not the same as home insurance.

Mortgage default insurance protects the lender if the mortgage is not paid. The cost is based on your down payment size and the mortgage amount. It often increases your monthly payment because it is commonly added to the mortgage.

There is also a detail that catches people off guard. In some cases, tax applies to the insurance premium and it may need to be paid in cash instead of being rolled into the mortgage. That means you may need extra money available even if your down payment is already saved.

🚚 Move In Money Most People Forget

A lot of “real” costs show up after the sale feels done.

Moving Costs

Truck rental, movers, boxes, and time off work can add up fast.

Utility Setup And First Bills

Deposits or setup charges can come up depending on the provider and your history.

Overlap Costs

If you are renting, you might have a month where you pay rent and mortgage around the same time.

Immediate Fixes And Purchases

Even a well-cared-for home usually needs a few things right away. Curtains, locks, tools, a lawn mower, small repairs, and touch up supplies are common.

This is why I like buyers to plan for move-in money the same way they plan for a down payment, as a real number with a buffer.

🧰 Build A Buffer So One Surprise Doesn’t Break You

The first year of ownership is when “small surprises” show up.

Maybe the hot water tank is older than you thought. Maybe a fence needs work. Maybe you learn the hard way that your new place needs better drainage or a quick plumbing fix.

A buffer is not about expecting problems. It is about keeping your stress low if something pops up.

How much buffer you need depends on the home. Older homes often come with more unknowns. Condos can be simpler for maintenance, but you still want room for one-time expenses and monthly budget changes.

📌 Pro Tip

If your budget is tight, do not try to fix that by skipping the buffer. Fix it by choosing a home with a payment you can handle and leaving cash in the account on purpose.

✅ A Simple Planning Checklist Before You Shop

Here is a clean way to get ready without overcomplicating it.

Get A Mortgage Pre-Approval

This gives you a realistic price range and helps you understand your likely payment.

List Your Full Cash Plan

Write down your down payment, your closing cost target, and your move-in money target. If the total feels heavy, adjust your purchase range early.

Keep Your Credit Stable

Avoid new debt, keep payments on time, and do not make major financing moves right before you apply.

Talk Through The “What Ifs”

What if the home needs a new roof in two years? What if you need a car soon? What if rates change before closing? Planning these out makes your budget smarter.

🎉 Final Thoughts

Buying a home is much easier when you plan for the full cash picture, not just the down payment. When you know what you need for closing, move-in, and a basic buffer, you can shop with confidence and avoid last-minute surprises.

If you are unsure how much to budget for closing costs in your price range, or how mortgage insurance changes your cash needed, I’d be happy to help.

📞 Call or text me at (639) 295-4696

📧 tanner@twrealestate.ca

🌐 twrealestate.ca

I can help you map out the numbers so the process feels a lot more straightforward.

Categories

Recent Posts

GET MORE INFORMATION