How Much House Can You Really Afford?

🏡 How Much House Can You Really Afford?

Affordability is not just about what a lender approves. It is about whether your home still fits when life gets busy, expenses rise, or plans change.

A pre-approval can feel exciting. Suddenly, listings feel possible instead of intimidating. That is also where many buyers stop asking deeper questions.

The bank answers one thing only, how much risk they are willing to take. Real affordability answers whether the payment works for your lifestyle, your savings, and your future flexibility.

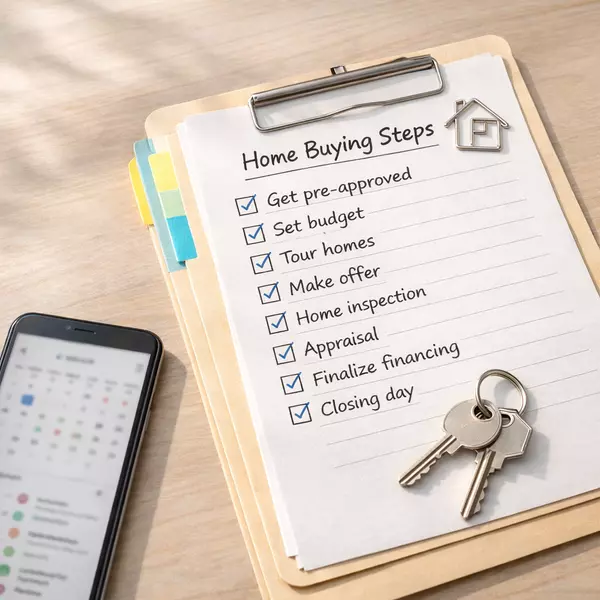

🔍 Why Pre-Approval Is Only the Starting Line

Mortgage approval is built around rules and ratios. Those rules protect the lender, not your comfort.

A lender looks at income, debts, and stress-tested payments to decide if you qualify. They are not checking whether you still have room to travel, save, or handle surprises.

When buyers treat the approved amount as a target instead of a ceiling, they often end up stretched even if nothing goes wrong.

The goal is not to buy the most house possible. The goal is to buy a home that still feels manageable on an average month, not just a good one.

💼 Start With Your Gross Household Income

Affordability always starts with income, but lenders and real life do not count income the same way.

Income that usually counts:

-

Salaries and hourly wages

-

Guaranteed bonuses

-

Reliable self-employment income, often averaged over two years

Income that is often excluded:

-

Overtime that is inconsistent

-

Side income that cannot be documented

📌 Pro Tip: If income cannot be verified on paper, it usually will not count for approval, even if you rely on it personally.

Knowing which income is solid helps prevent building a budget that only works on optimistic assumptions.

📊 Understand Lender Ratios as Guardrails

Most lenders rely on two main ratios when setting approval limits.

Gross Debt Service (GDS) looks at housing costs compared to gross income.

Total Debt Service (TDS) looks at housing costs plus other debts.

Housing costs usually include:

-

Mortgage payment calculated at the stress-test rate

-

Property taxes

-

Heating

-

Condo fees, if applicable

These ratios create the upper edge of approval. They do not define what feels comfortable month to month.

🧾 Add Up Your True Monthly Housing Cost

Many buyers only focus on the mortgage payment. That is where budgets often break.

A realistic monthly housing number should include:

-

Mortgage payment

-

Property taxes, which vary by location and assessment

-

Heat, power, and water

-

Condo fees, if buying a condo

When one of these is underestimated, the budget feels tight after possession even if the purchase seemed affordable on paper.

🧪 The Stress Test in Plain Language

Your mortgage is not approved using today’s rate alone.

You must qualify as if rates were higher. This is meant to prove you could handle future increases.

In practice, this means:

-

You might afford the payment today

-

You still have to qualify at a higher hypothetical rate

This often surprises first-time buyers and can reduce buying power more than expected.

💰 Down Payment Is Only the Beginning

Affordability is not just about monthly payments. It is also about what cash you have left after you buy.

Beyond the purchase price, plan for:

-

Down payment

-

Closing costs like legal fees, inspections, and title insurance

-

Immediate setup costs such as utilities, furniture, or small fixes

-

An emergency buffer for unexpected repairs or income changes

📌 Pro Tip: Using every dollar to buy a home may work on paper, but it leaves no margin when something breaks or life shifts.

🧮 Turning Approval Into a Real-Life Budget

Many buyers create a second affordability test that goes beyond lender math.

Common comfort ranges include:

-

Housing costs around 30–35% of gross income

-

All debts under about 40% of gross income

-

Ongoing monthly savings after moving in

If saving drops to zero, the home may be too expensive even if the bank approves it.

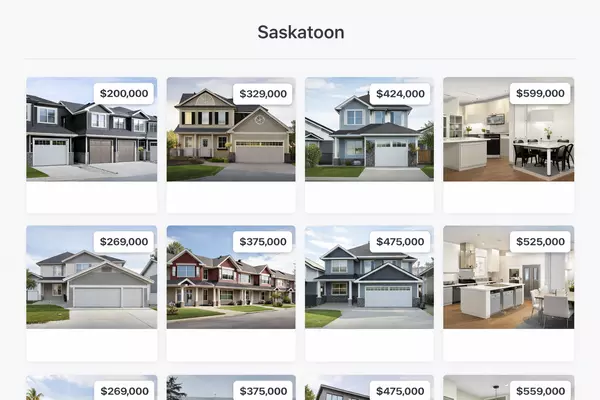

⚠️ Saskatchewan Tradeoffs Buyers Actually See

Some affordability risks only show up over time.

Common examples include:

-

Variable-rate payments rising even after stress testing

-

Condo fees that start low and increase

-

Older homes trading a lower price for higher maintenance uncertainty

-

Stretching so far that future plans get delayed

Affordability should be tested against harder years, not just best-case ones.

🎉 Final Thoughts

Buying a home should support your life, not shrink it. When affordability is measured beyond approval numbers, homeowners tend to feel confident instead of constantly stretched.

If you are unsure how lender numbers translate into a realistic monthly budget, or how much flexibility you should keep, I would be happy to help.

📞 Call or text me at (639) 295-4696

📧 tanner@twrealestate.ca

🌐 twrealestate.ca

Making smart affordability decisions upfront is one of the best ways to enjoy homeownership long after move-in day.

Categories

Recent Posts

GET MORE INFORMATION