How to Budget for a Home Purchase Without Feeling Stretched

🏡 How to Budget for a Home Purchase Without Feeling Stretched

📊 Start With a “Safe” Monthly Number

Before you look at listings, pick a monthly payment that feels comfortable, not just possible. The goal is to own a home and still enjoy your life, save money, and handle surprises.

A simple way to set this number is to think in ranges:

-

A payment that feels easy

-

A payment that feels doable but tight

-

A payment that feels stressful

Aim for the “easy” or “doable” range, not the stressful one. If rates rise, a car breaks down, or your bills increase, you will be glad you left room.

🧾 Map Out Your Real Monthly Cash Flow

A budget only works if it matches real life. Start with what comes in and what goes out each month.

Write down:

-

Take home income (what actually hits your bank account)

-

Fixed costs (rent, childcare, phone, subscriptions, insurance, debt payments)

-

Flexible spending (groceries, gas, eating out, hobbies)

-

Savings goals (emergency fund, retirement, travel, future plans)

If your spending changes month to month, look at a few months of bank statements and average it. This gives you a more honest picture than guessing.

Your housing budget should fit inside your life, not replace your life.

🧠 Check Your Debt Load Before You Shop

Lenders look at your debts because they want to see how much monthly room you really have. Even if you are approved, high debt payments can make home ownership feel tight fast.

Add up your monthly debt payments, like:

-

Car loans

-

Student loans

-

Credit cards (minimum payments)

-

Lines of credit

Then ask yourself: if you added a home payment on top of this, would your month still feel manageable?

📌 Pro Tip: If your credit card balance is high, paying it down can sometimes improve your monthly comfort more than saving the same amount, because it lowers your ongoing payments and gives you more flexibility.

🏠 Build the Full Housing Payment (Not Just the Mortgage)

Many buyers only focus on the mortgage payment, but the real monthly cost is a bundle of things.

Include:

-

Mortgage payment

-

Property taxes (these may be paid monthly or in larger chunks, depending on how your setup works)

-

Home insurance

-

Utilities (power, water, heat, internet)

-

Maintenance and repairs

A helpful habit is to set aside a small monthly “house fund” for upkeep. Even newer homes have costs, and older homes can surprise you.

🧰 Know Your Upfront Costs Before Closing Day

Your monthly payment matters, but so does the cash you need to get into the home. Buyers can feel stressed when they forget about upfront costs and then rush to cover them.

Upfront costs usually include:

-

Down payment

-

Legal fees

-

Home inspection (if you choose to do one)

-

Adjustments at closing (like property taxes or utilities the seller already paid)

-

Registration costs and other closing items your lawyer will confirm

A good rule is to plan for both the down payment and a separate “closing costs” buffer. Keeping them separate helps you avoid spending your full savings on the down payment and then feeling stuck.

🧱 Plan for the Costs People Forget

Even if your budget looks perfect on paper, these costs can creep in and throw things off.

Common “forgotten” costs:

-

Moving truck or movers

-

Immediate purchases (window coverings, tools, lawn equipment, snow removal supplies)

-

Small fixes you notice after possession

-

Furniture that fits the new space

-

Condo fees (if you buy a condo or townhouse)

None of these have to be huge, but they add up fast when they all happen at once.

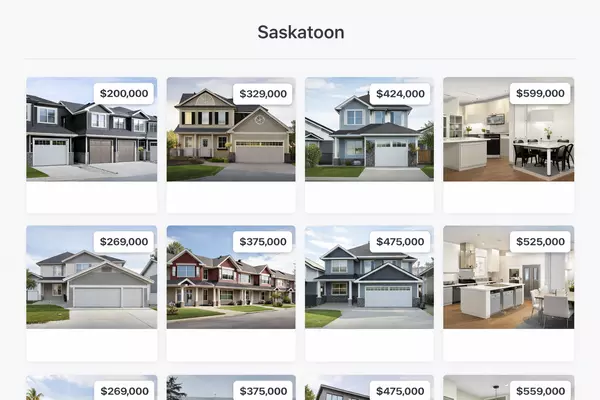

✅ Use Pre-Approval to Protect Your Budget

Pre-approval is useful because it gives you a realistic range and helps you move quickly when you find the right place. But it is not a “safe spending limit.”

Some buyers get approved for a number that would make them house rich and cash poor. A better approach is:

-

Get pre-approved

-

Set your personal max below that number

-

Shop based on what feels comfortable monthly, not what the bank says you can handle

📌 Pro Tip: When you get your pre-approval, ask for a quick comparison of a few price points, not just the maximum. Seeing the payment difference between, say, three options helps you choose a home price that still leaves room for savings and life.

🎉 Final Thoughts

Budgeting for a home is really about building a plan that still works when life gets busy, expensive, or unexpected. If you focus on your true monthly comfort, include the full cost of ownership, and keep cash aside for closing and move-in items, you will feel a lot more confident when it is time to make an offer.

If you are unsure how to set a realistic monthly number, or what costs to plan for in your situation, I’d be happy to help.

📞 Call or text me at (639) 295-4696

📧 tanner@twrealestate.ca

🌐 twrealestate.ca

When the numbers are clear, decisions get easier, and you can buy with confidence instead of pressure.

Categories

Recent Posts

GET MORE INFORMATION