Sell or Refinance in 2026? A Clear Way for Homeowners to Decide

by Tanner Washington

🏠 Sell or Refinance in 2026? A Clear Way for Homeowners to Decide

🧠 Why This Decision Feels Harder Right Now

Many homeowners feel stuck between two choices that both seem reasonable. Mortgage rates are lower than they were, which makes refinancing tempting. At the same time, home prices are calmer than the peak years, which makes selling feel less urgent but also less exciting.

A balanced market removes pressure, but it also removes easy answers. This decision is less about guessing where the market goes next and more about choosing the path that fits your life and finances today.

📉 What Changed Since You Took Your Mortgage

If you locked in during the higher rate years, your current payment likely feels heavy compared to today’s options. Even a small rate drop can make a noticeable difference in monthly costs.

At the same time, price growth has slowed. That does not mean homes have lost value across the board, but it does mean equity is growing more slowly. For many homeowners, equity now comes more from paying down the mortgage than from fast appreciation.

This mix is what creates the crossroads.

💸 Staying Put by Refinancing: When the Math Works

Refinancing replaces your existing mortgage with a new one. Homeowners usually do this to lower their rate, reduce monthly payments, access equity, or adjust their mortgage structure.

Refinancing often makes sense when you plan to stay in your home and want better cash flow. Lower payments can free up money for savings, renovations, or everyday expenses.

The trade-off is cost. Breaking a mortgage can come with penalties, plus legal and appraisal fees. Refinancing also keeps you tied to future market changes, good or bad.

📌 Pro Tip: Refinancing usually works best when you plan to stay put long enough for the monthly savings to outweigh the upfront costs.

🏠 Turning Equity Into Flexibility by Selling

Selling converts your home into cash and closes the chapter on your current mortgage. This can be appealing if you are moving, downsizing, upsizing, or simplifying your finances.

The benefit is flexibility. You unlock your equity now and remove ongoing carrying costs. You also avoid refinance penalties and future market uncertainty tied to that property.

The downside is that balanced markets reward realistic pricing. Homes that are priced correctly still sell, but stretching expectations often leads to longer listing times. Selling also comes with Realtor fees, legal costs, and the question of what housing comes next.

📌 Pro Tip: In steady markets, strong pricing strategy matters more than perfect timing.

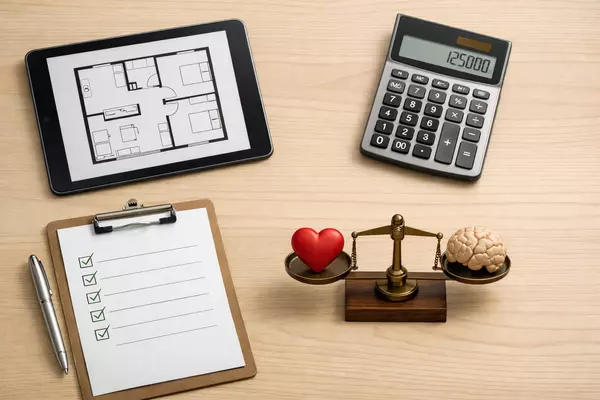

⚖️ Comparing the Two Paths Side by Side

Refinancing keeps you invested in your home and adjusts your mortgage to today’s rates. It suits homeowners focused on stability and long-term plans.

Selling turns equity into choice. It suits homeowners who value flexibility, mobility, or a clean financial reset.

Neither option is “safer” by default. The better choice depends on how long you plan to stay, how much risk you are comfortable with, and what you want your next few years to look like.

📍 Market and Mortgage Factors That Matter

Most mortgages renew every five years, so many homeowners will face a decision soon no matter what. Fixed-rate penalties can vary widely, while variable-rate penalties are often smaller.

Local market conditions still matter. Supply, demand, and employment trends can all influence outcomes, even in a balanced national market.

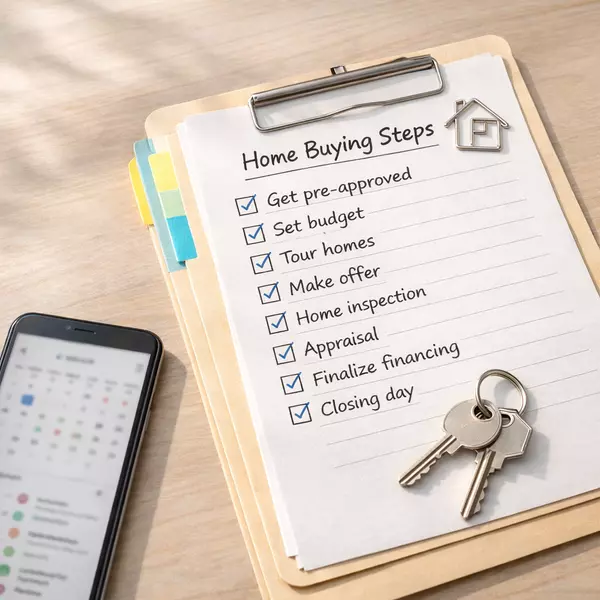

🧮 The Three Checks to Run Before You Choose

Start with the numbers. Compare your current mortgage to realistic refinance options and include penalties and fees.

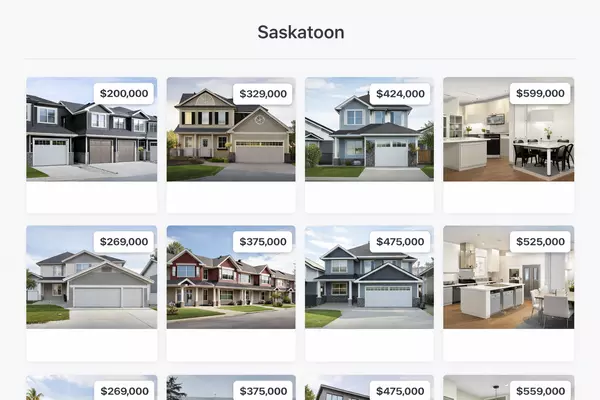

Next, understand your home’s value today. A current market comparison shows what buyers are actually paying, not just what listings ask.

Finally, look beyond the spreadsheet. Lifestyle plans, job stability, and stress levels matter just as much as interest rates.

🎉 Final Thoughts

Early 2026 is not about rushing into a move. It is about choosing with intention in a calmer, more balanced market. Refinancing often fits homeowners who want better cash flow and plan to stay put, while selling often fits those who want flexibility or a fresh start.

If you are unsure how penalties, pricing, or timing apply to your situation, I’d be happy to help.

📞 Call or text me at (639) 295-4696

📧 tanner@twrealestate.ca

🌐 twrealestate.ca

Clear decisions come from clear information, and that is exactly what I help homeowners get.

🏠 Sell or Refinance? A Clear Way for Homeowners to Decide

🧠 Why This Decision Feels Harder Right Now

Many homeowners feel stuck between two choices that both seem reasonable. Mortgage rates move over time, which can make refinancing tempting. At the same time, home prices go through calmer periods after strong growth, which can make selling feel less urgent but also less exciting.

A balanced market removes pressure, but it also removes easy answers. This decision is less about guessing where the market goes next and more about choosing the path that fits your life and finances today.

📉 What Changed Since You Took Your Mortgage

If you locked in during a higher rate period, your current payment may feel heavy compared to newer options. Even modest rate changes can make a noticeable difference in monthly costs.

At the same time, price growth can slow. That does not mean homes lose value across the board, but it does mean equity often grows more gradually. For many homeowners, equity comes as much from paying down the mortgage as it does from market appreciation.

This mix is what creates the crossroads.

💸 Staying Put by Refinancing: When the Math Works

Refinancing replaces your existing mortgage with a new one. Homeowners usually do this to lower their rate, reduce monthly payments, access equity, or adjust their mortgage structure.

Refinancing often makes sense when you plan to stay in your home and want better cash flow. Lower payments can free up money for savings, renovations, or everyday expenses.

The trade-off is cost. Breaking a mortgage can come with penalties, plus legal and appraisal fees. Refinancing also keeps you exposed to future market changes, good or bad.

📌 Pro Tip: Refinancing usually works best when you plan to stay put long enough for the monthly savings to outweigh the upfront costs.

🏠 Turning Equity Into Flexibility by Selling

Selling converts your home into cash and closes the chapter on your current mortgage. This can be appealing if you are moving, downsizing, upsizing, or simplifying your finances.

The benefit is flexibility. You unlock your equity now and remove ongoing carrying costs. You also avoid refinance penalties and future market uncertainty tied to that property.

The downside is that balanced markets reward realistic pricing. Homes that are priced correctly still sell, but stretching expectations often leads to longer listing times. Selling also comes with Realtor fees, legal costs, and the question of what housing comes next.

📌 Pro Tip: In steady markets, strong pricing strategy matters more than perfect timing.

⚖️ Comparing the Two Paths Side by Side

Refinancing keeps you invested in your home and adjusts your mortgage to current rates. It suits homeowners focused on stability and long-term plans.

Selling turns equity into choice. It suits homeowners who value flexibility, mobility, or a clean financial reset.

Neither option is “safer” by default. The better choice depends on how long you plan to stay, how much risk you are comfortable with, and what you want your next few years to look like.

📍 Market and Mortgage Factors That Matter

Most mortgages renew every five years, so many homeowners will face a decision eventually, regardless of timing. Fixed-rate penalties can vary widely, while variable-rate penalties are often smaller.

Local market conditions still matter. Supply, demand, and employment trends can all influence outcomes, even in balanced environments.

🧮 The Three Checks to Run Before You Choose

Start with the numbers. Compare your current mortgage to realistic refinance options and include penalties and fees.

Next, understand your home’s value today. A current market comparison shows what buyers are actually paying, not just what listings ask.

Finally, look beyond the spreadsheet. Lifestyle plans, job stability, and stress levels matter just as much as interest rates.

🎉 Final Thoughts

This decision is rarely about perfect timing. It is about choosing with intention in a steadier market. Refinancing often fits homeowners who want better cash flow and plan to stay put, while selling often fits those who want flexibility or a fresh start.

If you are unsure how penalties, pricing, or timing apply to your situation, I’d be happy to help.

📞 Call or text me at (639) 295-4696

📧 tanner@twrealestate.ca

🌐 twrealestate.ca clear information, and that is exactly what I help homeowners get.

Categories

Recent Posts

GET MORE INFORMATION