Homebuying Checklist: Key Mistakes to Avoid Before You Make an Offer

🏡 Homebuying Checklist: Key Mistakes to Avoid Before You Make an Offer

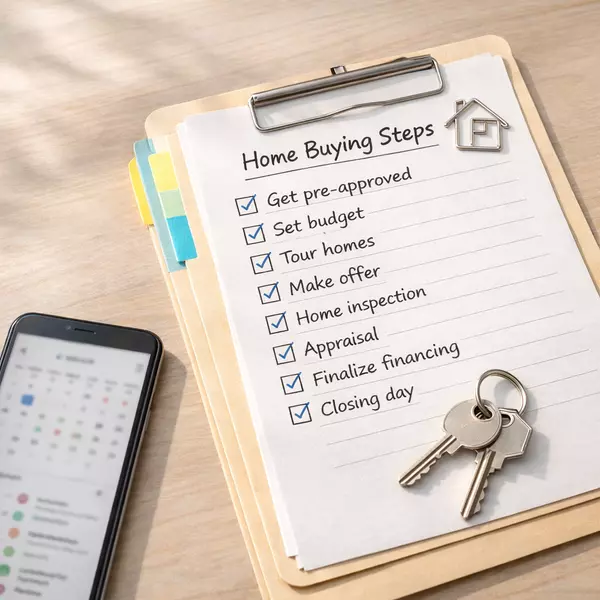

Buying a home is exciting, but it is also one of the biggest financial decisions most people make. Many buyers focus on the house itself and miss important steps that can cause stress, delays, or regret later. Knowing the most common mistakes ahead of time helps you move forward with confidence and avoid problems that are completely preventable.

💼 Get Your Finances Ready Before House Hunting

One of the biggest mistakes buyers make is starting their search before fully understanding their finances. Looking at homes without a mortgage pre-approval often leads to disappointment or rushed decisions.

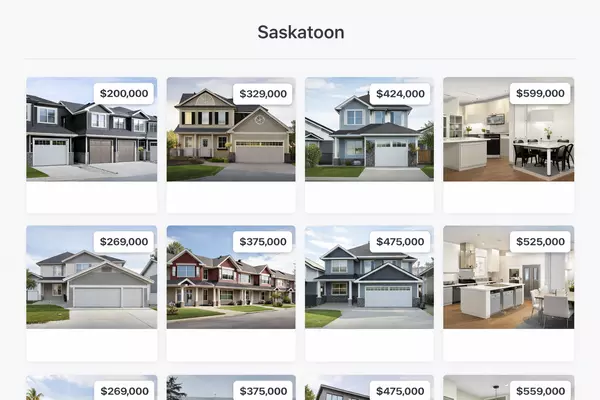

A proper pre-approval shows what a lender is willing to lend you, not just what you hope to spend. It also helps sellers take your offer seriously, especially in competitive Saskatoon neighbourhoods. Beyond the mortgage amount, buyers should be clear on monthly payments, property taxes, utilities, and insurance so the numbers make sense long after possession day.

📌 Pro Tip

A budget that feels comfortable on paper should still leave room for savings, maintenance, and life changes. Stretching to the maximum approval amount often creates pressure later.

🔍 Don’t Skip the Inspection (It Could Save You Thousands)

Skipping a home inspection may seem like a way to save money or strengthen an offer, but it often leads to costly surprises. An inspection gives you a clearer picture of the home’s condition, from the foundation and roof to plumbing and electrical systems.

In Saskatchewan, inspections are especially important because of seasonal temperature changes, older housing stock in some areas, and soil conditions that can affect foundations. Even well-maintained homes can have hidden issues that only show up under professional review.

An inspection does not mean a home is “bad.” It gives you information so you can plan, negotiate, or walk away if needed.

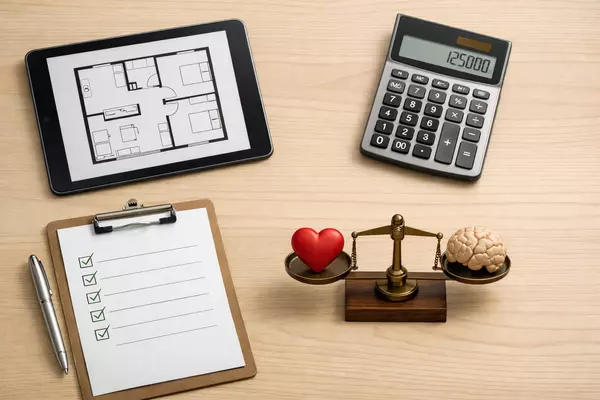

🧮 Think Beyond the Price Tag

The purchase price is only one part of the cost of buying a home. Many buyers forget to plan for expenses that show up right after possession.

These can include legal fees, land transfer costs, property taxes, utility setup, immediate repairs, and basic maintenance items like snow removal or lawn care. Older homes may also need upgrades sooner than expected.

Understanding these costs early helps prevent financial stress and makes sure the home fits your real budget, not just your offer price.

📍 Consider Location and Long-Term Fit

It is easy to fall in love with finishes, paint colours, or staging, but location plays a bigger role in long-term satisfaction. Buyers should think about commute times, schools, future development, and how the neighbourhood fits their lifestyle.

In Saskatoon, different areas offer very different experiences. A home that feels perfect today may not suit you in five years if your needs change. Thinking ahead also protects resale value, even if selling feels far off right now.

🧘♂️ Avoid Emotional Decisions and Unrealistic Expectations

Buying a home can feel emotional, especially in a fast-moving market. Fear of missing out or pressure from multiple offers can lead buyers to overpay or overlook important details.

Another common mistake is waiting for a “perfect” home. No property checks every box. The goal is finding a home that meets your needs, fits your budget, and works for your life right now.

Staying grounded and focused on priorities helps you make decisions you will feel good about long after the keys are in your hand.

📣 Why Professional Guidance Matters

Trying to navigate the buying process alone often leads to missed details and avoidable mistakes. A knowledgeable real estate professional helps you understand local market conditions, spot red flags, and negotiate with confidence.

From coordinating inspections to explaining paperwork and timelines, having guidance keeps the process organized and less stressful. The right support helps you avoid common pitfalls and focus on making smart, informed choices.

🎉 Final Thoughts

Avoiding common home-buying mistakes comes down to preparation, patience, and clear decision-making. When you understand your finances, plan for the full cost of ownership, and look beyond first impressions, you put yourself in a stronger position from day one.

If you are unsure about budgeting, inspections, neighbourhood fit, or how to approach an offer, I’d be happy to help.

📞 Call or text me at (639) 295-4696

📧 tanner@twrealestate.ca

🌐 twrealestate.ca

Buying a home does not have to feel overwhelming. With the right plan and local guidance, you can move forward knowing you made a smart, well-informed decision.

Categories

Recent Posts

GET MORE INFORMATION